The Legal Marketing Technology Ecosystem: Identifying Gaps and Opportunities for Firms of All Sizes

In a study conducted by RubyLaw and Calibrate Legal, we identify gaps and opportunities for firms of all sizes, maturities, and complexities. Compared to other sectors, legal—and specifically the marketing and business development domain—is lagging, as firms fail to invest in critical systems that can drive greater efficiencies and reinforce under-resourced teams. Our findings reveal a substantial gap in technological adoption between large and small firms, with glaring holes where key systems should be. In places where complementary systems should or could be paired, they are not, suggesting a lack of budget, internal support, or purchasing power. Equally, the use of pre-integrated or modular systems is under-represented, meaning that marketing and business development teams miss out on convenient synergies that can easily propel them forward.

Overview

Success with marketing technology depends on the tools, the purposes for which they’re used, the processes for using them, and the people using them—all constrained by time and budget. Few firms operate in an ideal setting, making it challenging for most to optimize for performance. For two years, RubyLaw, a Content Lifecycle Management platform, has studied the legal marketing technology ecosystem, and we’ve developed a blueprint to visualize how systems come together to deliver results. This year, we have partnered with Calibrate Legal, a recruiting and consulting firm specializing in law firms, to update further and evolve the blueprint and answer the question: How are legal marketing and business development teams deploying technology to meet business objectives? We learned that, whether because of budgetary constraints, alternate strategic priorities, a lack of awareness, or a cultural unwillingness to adopt new systems, law firms are lagging in their adoption of modern marketing technology.

About the Study

Our study was conducted during the second quarter of 2021. We surveyed a statistically significant number of members of the legal marketing community (n>50), with respondents representing the following segments:

Revenue: Representation from firms across three revenue segments, including <$100 million (35%), $100-$500 million (41%), and $500 million-plus (24%)

Attorneys: Relatively even distribution by number of lawyers, including 1-500 (55%) and 500-plus (45%)

Ranking: Approximately 70% of respondents represented Am Law-ranked firms, with 27% in the top 50, 18% from 51-100, and 24% from 101-200.

Roles: In terms of roles, nearly 90% of respondents were either marketing executives or senior marketers, with the remainder representing senior and junior marketing and business development roles.

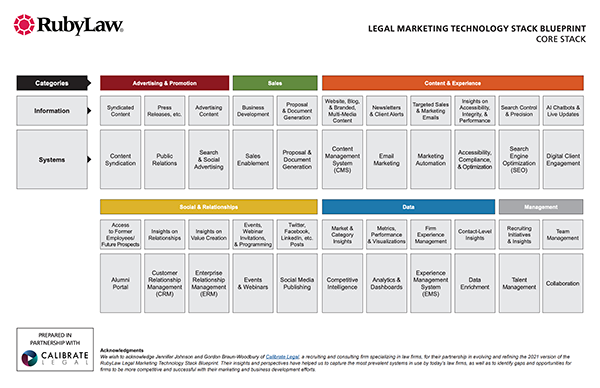

Respondents completed 25 multiple-choice questions about the legal marketing technology ecosystem structures, selecting multiple options (where applicable) to indicate more than one system in use and manually adding unlisted systems or processes (where applicable). Specifically, they were asked to show which system their firm used, with definitions provided to clarify how to interpret “Content Syndication,” “Content Management System,” “Email Marketing,” and so on. The systems correspond to the RubyLaw Legal Marketing Technology Stack, shown below and available for download here.

Legal marketers and business developers are becoming increasingly reliant on technology. Yet, the time required to become educated, make strategic decisions

about particular systems, successfully roll out and adopt software, and leverage it to gain a competitive advantage is as considerable as the amount required to perform general marketing and business development activities. This poses a unique dilemma: when and how can legal marketers keep on the cutting edge of marketing technology?

The RubyLaw Legal Marketing Technology Stack provides a visualization of the legal marketing technology ecosystem and articulates our perspective: it’s critical to select appropriate size and power systems while avoiding misfits, taking advantage of pre-integrated products like RubyLaw as needs and objectives become increasingly complex.

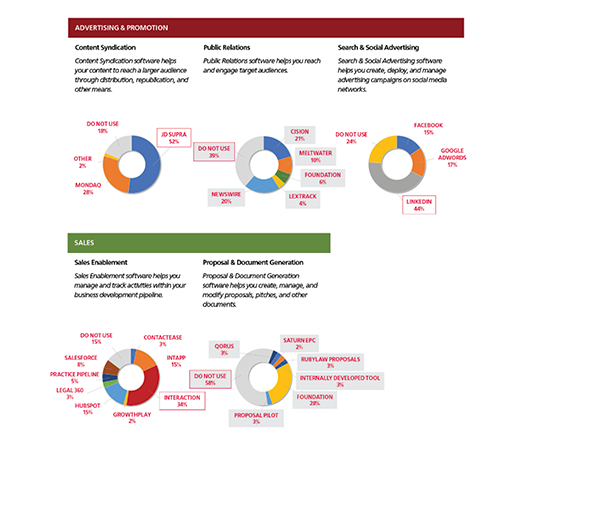

Findings

Our findings are organized by system, with each laddering up to a particular category of marketing technology. Definitions are provided for each system, with findings captured in pie charts. It is also worth noting that, while participants included a larger proportion of RubyLaw and Calibrate Legal clients, respondents represented the broader legal marketing community.

(Click the following thumbnails to view enlarged versions.)

Insights

In preparing our insights, we reviewed several sources, including the findings of ILTA’s 2020 Technology Survey and related commentary in Law.com, LegalTechnology.com, and Thomson Reuters’ Legal Executive Institute. We also reviewed past editions of the RubyLaw Legal Marketing Technology Stack and Calibrate Legal’s most recent survey of law firm departments in North America and the UK. We arrived at the following insights:

1. A sizeable maturity gap exists between large and small firms. Whether because of budget, specialization, human resources, or market dynamics, the larger the law firm—by revenue or number of attorneys—the more mature the marketing technology stack.

On average, 49% of firms with revenues of less than $100 million stated that they did not use one or more of the six marketing technology categories. By contrast, only 15% of firms with revenues of $500 million-plus stated that they did not use one or more of the categories.

2. Key systems are absent from firms’ marketing tech stacks. Delving deeper into the first insight, we found that key systems widely used in other sectors are not currently in use by law firms. For instance:

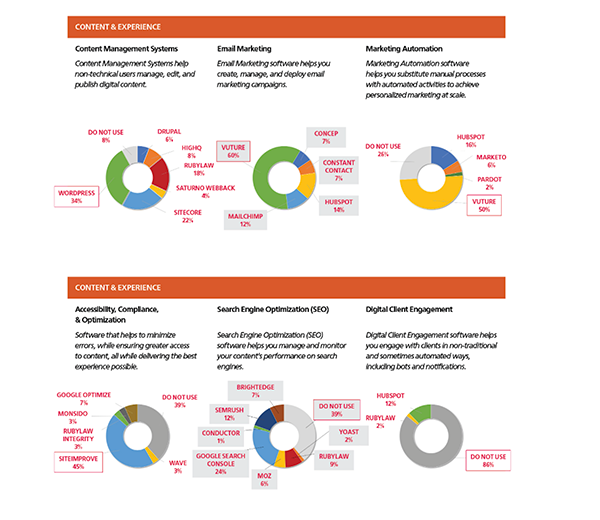

—Across all firms, we identified six types of marketing technology that are least widely used, i.e., 40% or more respondents reported that they do not use them. Surprisingly, Search Engine Optimization software, a basic digital marketing tool, falls into the “least widely used” category. Given the importance of search to successful digital marketing, it appears that many law firms are missing a fundamental capability.

—Nearly 90% of respondents are not using any form of Digital Client Engagement software. This type of software includes chatbots and desktop notifications, two tools that enable direct, immediate, and personalized interaction with website visitors and other important stakeholders. We expect that law firms will soon follow other B2B sectors in adopting these tools and learning to apply them.

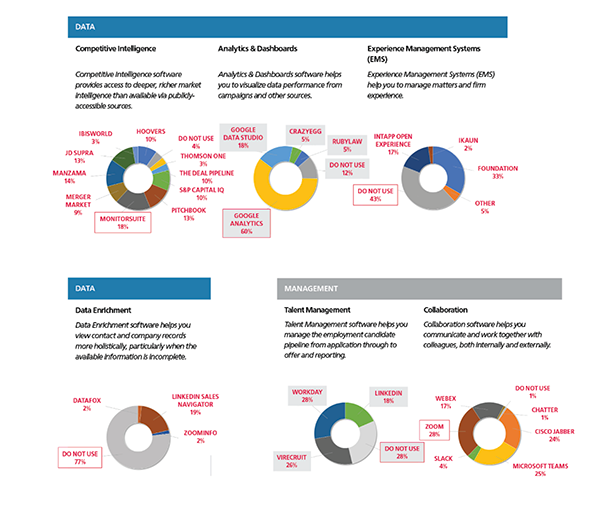

—More than 75% of respondents stated that they are not enriching their client data using third-party data platforms. This may be due to concerns—rightly or wrongly—about data privacy. We believe, though, that data enrichment is the next frontier in law firm relationship management, and we anticipate that firms will soon recognize the value of enriched data and invest accordingly.

3. 20% of CRM users are not using ERM. A significant portion of respondents (20%) reported that they are using a Customer Relationship Management (CRM) system with no Enterprise Relationship Management (ERM) platform. Most, if not all, modern legal CRM systems have integrated ERM systems, which contribute immense value by automating new and changed contacts. We predict that the ERM-less firms will upgrade their CRM technology within the next two years; that, or they will fall behind their competitors.

4. Law firms are slow to embrace structured business development. While most CRM platforms are designed to facilitate sales enablement, considered in this context as opportunity management, 40% of respondents say they are not using any sales enablement tool. Our observations tell us that law firms using structured opportunity management processes do so only in niche practices; few, if any, use sales enablement tools on a firmwide basis. Based on entrenched law firm cultures, we predict slow progress in the adoption of sales enablement tools in the industry.

5. Marketing automation is underutilized, particularly given resource constraints. Finally, we noted that 25% of firms are not leveraging marketing automation. Marketing automation is an efficiency driver, enabling teams to automate the sending of marketing content and capture critical information and trigger ongoing processes and workflows. Whether it’s to send an automated email to a prospect that has downloaded a gated piece of content or to initiate the start of a workflow to enroll an interested party in a particular offering, marketing automation can help resource-constrained teams to lighten the (manual) load while simultaneously increasing engagement with clients and prospects.

We will also plan to address how best to distinguish the extent of systems integration in the data. For instance, respondents may be using a single solution for both Customer Relationship Management (CRM) and Sales Enablement or two separate solutions. We currently cannot determine if there is integration between the respective systems, but we will aim to remedy this in 2022.

We hope that legal marketers, and the firms they represent, will utilize this study in conjunction with the 2021 edition of the RubyLaw Legal Marketing Technology Stack. We hope they seize the opportunity to leverage marketing technology to work more efficiently and effectively; create engaging, personalized experiences for key stakeholders; and carry the sector forward into a new era. ILTA

Parting Thoughts

While the legal sector and particularly the marketing and business development area, has traditionally lagged behind other verticals, we believe the issue lies not with talent or awareness. Legal marketers and business developers must be empowered to leverage technology that can accelerate growth and drive efficiencies.

Technology on its own, though, is not the solution. The empowerment of decision-makers, plus prudent decision-making around the right size and fit technology, is the key.

In addition to the findings of this study, which we hope will help legal marketers and business developers to make the cases for crucial mar-tech upgrades, we are pleased to share the 2021 edition of the RubyLaw Legal Marketing Technology Stack. In addition to mapping out the prevalent systems and brands in use by firms, it includes a blank stack for practitioners to visualize their stacks and identify opportunities to plan for enhancement.

As we look to future iterations of this study, we recognize that we have previously solicited input from a select group of third-party experts, mostly marketing leaders at Am Law 200 firms, for feedback on the design and evolution of the legal marketing technology stack. This is the first year that we have conducted our survey; in 2022, we will report a year-over-year change to assess how firms have adjusted.

This article originally appeared in Peer to Peer, ILTA's Quarterly Magazine, Issue #2, Volume 37.